Loan origination application has grown to be a significant component for banking companies, mortgage brokers, credit unions, and economic establishments. It can help streamline the complete financial loan process, from application to underwriting and remaining disbursement. A personal loan origination program plays a vital function in automating duties, lowering human mistake, and enhancing the overall efficiency of financial loan management. As the demand for digital lending methods grows, the usage of mortgage processing software program has become common throughout different sectors, especially in home loan and commercial lending. Companies are progressively trying to find industrial mortgage origination software to deal with sophisticated discounts and supply a far better consumer encounter.

Personal loan underwriting software package is another important aspect of the lending course of action. Underwriting is essential for assessing the chance affiliated with Every single borrower, and automating it guarantees quicker, far more exact choices. Mortgage loan origination application has transformed the way in which lenders course of action household mortgages. Applying mortgage loan origination program permits lenders to deal with every little thing from pre-qualification to closing seamlessly. Numerous monetary institutions are constantly trying to find the most beneficial personal loan origination computer software to keep up their competitive edge and give outstanding assistance to their clients.

House loan los units (bank loan origination programs) exclusively cater to home finance loan lenders, enabling them to deal with big volumes of apps efficiently. Financial loan origination software package for mortgage loan brokers is tailor-made to meet the exclusive demands of independent brokers who need powerful instruments to compete with bigger establishments. Commercial loan origination software program for brokers provides the same benefit, equipping brokers with technology that simplifies the customarily complicated planet of economic lending. Mortgage software program causes it to be less difficult for borrowers to submit their data digitally, increasing the two the velocity and accuracy from the loan origination approach.

An los system, or bank loan origination technique application, is meant to function a centralized platform the place all mortgage actions are tracked, monitored, and processed. A financial loan origination System commonly provides conclude-to-finish alternatives, masking everything within the initial consumer inquiry to ultimate personal loan approval. When considering the bank loan origination software program pricing, organizations have to have to evaluate the features, scalability, and integrations provided by Each individual System to ensure They're obtaining the finest value for his or her expenditure.

Home finance loan bank loan software has advanced substantially, incorporating purchaser marriage administration equipment for instance house loan personal loan officer crm systems to aid officers sustain solid associations with shoppers through the mortgage approach. A professional loan origination process focuses on facilitating much larger, much more elaborate industrial lending deals with characteristics like sturdy document administration and hazard assessment applications. Mortgage loan financial loan processing application assists lenders in controlling the different measures on the mortgage journey, making certain that all authorized, fiscal, and compliance prerequisites are met.

Customer mortgage origination units are built for personal financial loans, auto loans, and other purchaser credit score items, streamlining the appliance and acceptance procedure for retail clients. Mortgage loan processing software program makes sure that all necessary paperwork are gathered and verified, enabling smoother closings. Property finance loan underwriting program automates the vital task of threat evaluation, supporting lenders make additional informed selections quickly.

The list of financial loan origination systems out there in the marketplace right now is comprehensive, with many different financial loan origination method vendors offering specialised remedies for different types of lending operations. Choosing the ideal personal loan origination computer software for brokers requires careful thought of functions like ease of use, compliance instruments, and client guidance. Mortgage loan lending application delivers the infrastructure for controlling property finance loan loans effectively, from origination to servicing.

Bank loan origination software program for banking companies must take care of the intricate needs of banking institutions, such as regulatory compliance, possibility administration, and customer care. House loan los software program solutions are getting to be important for banks and mortgage lenders alike. Bank loan origination application providers regularly innovate to supply new attributes such as AI-run underwriting, digital document assortment, and real-time position monitoring.

The most well-liked bank loan origination software normally provides seamless integrations with core banking systems, compliance resources, and 3rd-party expert services like credit bureaus. Bank loan origination and servicing software package allow for institutions to manage the total life cycle of a personal loan, from software to payoff. Top house loan los units are regarded for his or her dependability, scalability, and compliance with marketplace regulations.

Personal loan officer software provides product sales help tools to help officers track prospects, handle their pipelines, and remain in contact with customers throughout the lending course of action. Top loan origination techniques offer robust safety features, consumer-pleasant interfaces, and strong automation instruments. Home loan personal loan origination systems are specifically significant for lenders seeking to process a substantial volume of financial loans effectively.

Professional bank loan underwriting program helps lenders in examining and approving big professional loans by automating economic Assessment and danger scoring. The top bank loan origination application for little business enterprise lending provides tailored alternatives for business people and modest business people who generally deal with difficulties securing financing. Absolutely free personal loan origination program solutions can be obtained for startups and little brokers but often have confined attributes as compared to compensated variations.

Top rated home loan mortgage origination programs are ranked based upon consumer assessments, function sets, and scalability. Home finance loan loan origination procedure vendors constantly up grade their choices to remain aggressive and meet the modifying demands of your lending sector. A personal loan functioning technique, normally often called a financial loan operating process los, offers a unified platform for managing bank loan origination, underwriting, documentation, and shutting.

Origination application aids lessen the guide effort expected in mortgage processing, bringing about more rapidly turnaround times and better buyer gratification. An los financial loan origination program gives conclusion-to-end financial loan processing capabilities, frequently with built-in compliance checks and audit trails. Credit underwriting program automates the evaluation of creditworthiness, assisting lenders make quicker, more steady choices.

Finding the most effective home finance loan personal loan origination application depends on factors like institution size, type of loans available, and loan operating system funds. A cloud dependent financial loan origination system delivers versatility, scalability, and distant access, which might be significantly crucial features in the fashionable lending ecosystem. Industrial personal loan processing software package is created to manage the exclusive troubles of business property and small business lending.

Personal loan processing programs streamline the management of mortgage apps, documentation, verifications, and approvals. The best mortgage origination application features comprehensive functions, easy integration, and intuitive interfaces. Shopper mortgage origination program enables financial institutions and credit rating unions to offer individual loans quickly and efficiently.

Business loan origination program is specialised to satisfy the requires of smaller organization and commercial borrowers. The ideal mortgage los units are known for their compliance instruments, consumer guidance, and potent reporting functions. Mortgage origination systems for credit score unions typically give customizable workflows and specialised compliance applications to satisfy regulatory demands.

Bank loan origination solutions can be found in various varieties, from off-the-shelf application to completely tailored enterprise platforms. Commercial housing financial loan origination program focuses on the unique needs of commercial house financing, providing specialized underwriting and valuation instruments. Home loan lending program companies are continually innovating, integrating AI, machine Finding out, and blockchain know-how to enhance their solutions.

A mortgage operating method los offers the backbone for modern electronic lending functions. Mortgage origination systems present comprehensive help for household and business property finance loan products and solutions, which includes pre-qualification, application, processing, underwriting, closing, and put up-closing activities. A business loan origination process is tailor-made to the particular workflows and documentation wants of enterprise lending.

Totally free property finance loan personal loan origination application may be suitable for startups or modest firms but typically lacks the robust characteristics required by greater establishments. Lending origination technique solutions range broadly in complexity and price tag, so institutions want to settle on properly. The top bank loan origination technique will rely upon the lender’s dimension, quantity, and target market.

Home finance loan loan running methods combine origination and servicing into an individual System, improving upon operational performance. The best industrial loan origination computer software offers capabilities such as monetary statement spreading, possibility grading, and covenant monitoring. A electronic loan origination program enables lenders to deal with all the mortgage approach on the web, bettering borrower fulfillment and operational efficiency.

House loan personal loan officer computer software assists personal loan officers continue to be organized and strengthen interaction with shoppers and realtors. Finding the most beneficial property finance loan bank loan origination program needs a watchful comparison of options, integrations, buyer assist, and pricing. Digital financial loan origination has revolutionized lending by supplying quicker processing, Improved borrower encounters, and minimized operational expenditures.

Home loan origination platforms integrate with third-social gathering companies like credit history bureaus, appraisal companies, and title providers to make a seamless workflow. Best loan origination program remedies give flexible deployment possibilities, including on-premises and cloud-primarily based products. A turnkey mortgage origination method gives a Prepared-to-deploy solution, minimizing implementation effort and time.

House loan bank loan program methods help every phase with the property finance loan method, from application to publish-closing. An origination System supplies lenders that has a centralized program for handling personal loan things to do and information. A corporate bank loan origination system is designed for big institutions working with complex company lending discounts.

Industrial mortgage software application permits enterprises to submit their purposes on the web, dashing up the acceptance approach. An origination procedure simplifies the management of personal loan purposes and underwriting workflows. A retail bank loan origination technique is focused on particular and home loans supplied directly to people.

Credit history union mortgage origination methods aid smaller money institutions contend with bigger banks by featuring State-of-the-art characteristics tailored for their wants. Stage bank loan origination program offers a consumer-pleasant interface for brokers and lenders. House loan mortgage application program enables shoppers to complete bank loan programs digitally, minimizing paperwork and processing time.

Major property finance loan origination software program platforms are identified for their robust compliance resources, scalability, and user-helpful design. Tough revenue personal loan origination software package is personalized to non-public lenders and buyers who cope with asset-based lending. Lending origination software helps economical institutions regulate the complete lending daily life cycle additional competently.

An internet loan origination procedure presents borrowers a chance to submit an application for financial loans from anyplace, rising accessibility and ease. Home finance loan loan underwriting software program automates the underwriting procedure, reducing guide get the job done and human error. An los financial loan origination procedure delivers an extensive Alternative for taking care of every single element of the lending method.

Home loan origination computer software programs offer integration with 3rd-social gathering suppliers, State-of-the-art reporting abilities, and compliance management resources. Automated loan origination techniques maximize performance and allow lenders to scale their operations with no proportional boost in headcount. The top loan origination devices are the ones that present you with a seamless consumer expertise, high security, and strong compliance attributes.

Los method software methods differ with regard to attributes, customization, and selling price, which makes it important to pick out the best one particular based upon company demands. A loan origination crm integrates buyer partnership management with the mortgage origination procedure, boosting consumer satisfaction and retention. Digital loan processing program solutions give a entirely paperless lending encounter, expanding operational performance and customer satisfaction.

Personal loan origination software distributors keep on to innovate by featuring new capabilities, Improved protection, and much better integrations. Crm loan origination platforms merge consumer administration with financial loan application processing, delivering an extensive look at of every borrower. Professional lending origination software package is created to take care of the complexities of business lending, from software through closing.

House loan financial loan processing units make sure just about every step of your property finance loan journey is managed efficiently and properly. The future of lending lies in adopting advanced systems like AI, device learning, and blockchain inside of loan origination options. Establishments that invest in the best personal loan origination software package now are positioning by themselves to lead the marketplace in customer fulfillment, effectiveness, and profitability tomorrow.

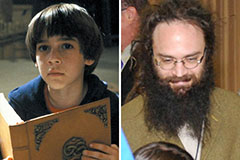

Barret Oliver Then & Now!

Barret Oliver Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now!